The Roth IAMS blog, Ramblings of an Asset Management Fanatic, is written by President & CEO of Roth IAMS, Bill Roth. In this space you will find the latest topics, trends and issues as they relate to the built environment from Bill’s point of view.

May. 03, 2024

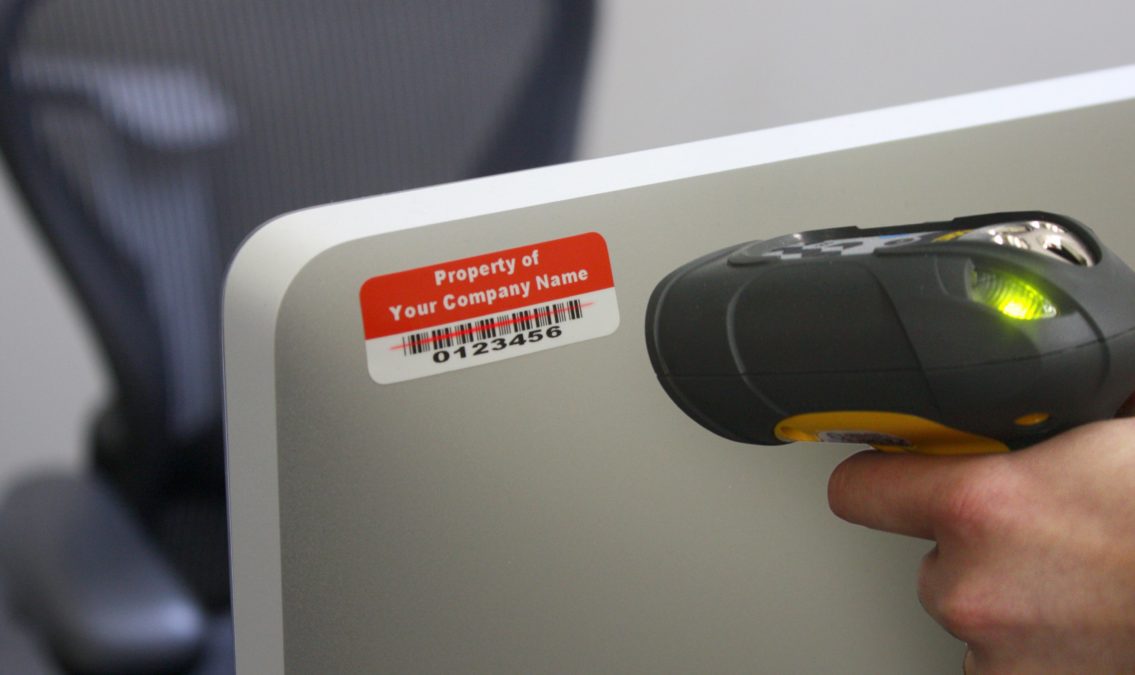

This week I continue sharing ideas based on conversations I had at the recent APPA National conference in Nashville. During one of the networking breakfast sessions, I was speaking with an individual who was involved in a project recently where he and his team partnered with a company to complete equipment inventory and tagging on […]

May. 02, 2024

I recently attended an APPA conference in Nashville and sat in on a presentation by...

Apr. 25, 2024

While I was at the gym today I was listening to a podcast interview with...

Apr. 18, 2024

Here we are, the final post recapping our Ask Bill Anything webinar. Thanks for taking...

Apr. 11, 2024

In the realm of asset management, one question always looms large as was the case...

Apr. 04, 2024

How often should you reassess your buildings? This is an interesting question we encounter frequently...

Mar. 28, 2024

Continuing with our blog series highlighting the questions and answers from the Ask Bill Anything...

Mar. 21, 2024

We are going to continue our session where we expand on the questions and answers...

Mar. 15, 2024

This week we will be answering the third question we received in our Ask Bill...

Mar. 06, 2024

[video width="1920" height="1080" mp4="https://rothiams.com/wp-content/uploads/2024/04/Roth-IAMS-Uncle-Sam-RC1.mp4" loop="true" autoplay="true"][/video] In a recent webinar I did called “Ask...

Feb. 29, 2024

Last week we began by making the case that you must understand the nature and...

Feb. 22, 2024

One of the most critical elements of any asset management program is a high level...

Feb. 13, 2024

This blog is going to be posted while I am on vacation with my family. ...

Feb. 08, 2024

Winter conference season is upon us folks. I just wrapped up two weeks of conferences...

Feb. 01, 2024

Although I (hope) possess more than four pieces of wisdom worth sharing, we have come...

Jan. 25, 2024

As we continue through our first blog series of 2024, I hope that some of...

Jan. 18, 2024

Welcome to my second post of the most influential wisdom that I have gained (so...

Jan. 11, 2024

I was having a conversation recently with a friend about the best pieces of wisdom...

Jan. 04, 2024

It's hard to believe that we are into the first week of 2024! I for...

Dec. 20, 2023

With the launch of our Preventative Maintenance (PM) program at the end of Part 3...

Dec. 12, 2023

Here we are with our third post on the two biggest hurdles to getting started...

Dec. 07, 2023

After last week's short interlude which allowed me to climb up on my soapbox and...

Dec. 01, 2023

Last week, I started a post on Equipment Inventory and Preventative Maintenance Planning, which I...

Nov. 22, 2023

Last week was the first of our new category of blogs, Operational Excellence, the second...

Nov. 16, 2023

After wrapping up another two-month blog series, I am excited to add a new category...

Nov. 07, 2023

We have arrived at the tenth and final post of this series. When I start...

Nov. 02, 2023

Now that we have introduced and dove into the details of each of the different...

Oct. 26, 2023

Last week I introduced the Element-Level Inventory (ELI) scope of work for facility condition data,...

Oct. 18, 2023

We have finally come to the most detailed and resource intensive methodology for collecting facility...

Oct. 12, 2023

Well, it only took me six posts to finally get to a point where you...

Oct. 05, 2023

In our last two posts, we explored the two most common types of building models...

Sep. 27, 2023

As part of our on-going series on the different types of facility condition datasets, this...

Sep. 22, 2023

Now that we have gone over how building modeling works, I wanted to provide a...

Sep. 14, 2023

This series of posts is going to explore the different types of Facility Condition datasets,...

Sep. 07, 2023

I have been working with a State-Level University system over the last couple of months...

Aug. 31, 2023

Last week I talked about the importance of finding and scheduling time to produce work,...

Aug. 24, 2023

As I write this, I am sitting in the Knoxville airport. It's a nice regional...

Aug. 18, 2023

On the wall of my home office, you will find a Serigraph Cel (a form...

Aug. 10, 2023

Last week's blog focused on how organizations can find themselves in a situation where they...

Aug. 03, 2023

A great many of the people I talk to complain about their CMMS (Work Order)...

Jul. 27, 2023

I hear a lot of people say that the world is getting more and more...

Jul. 21, 2023

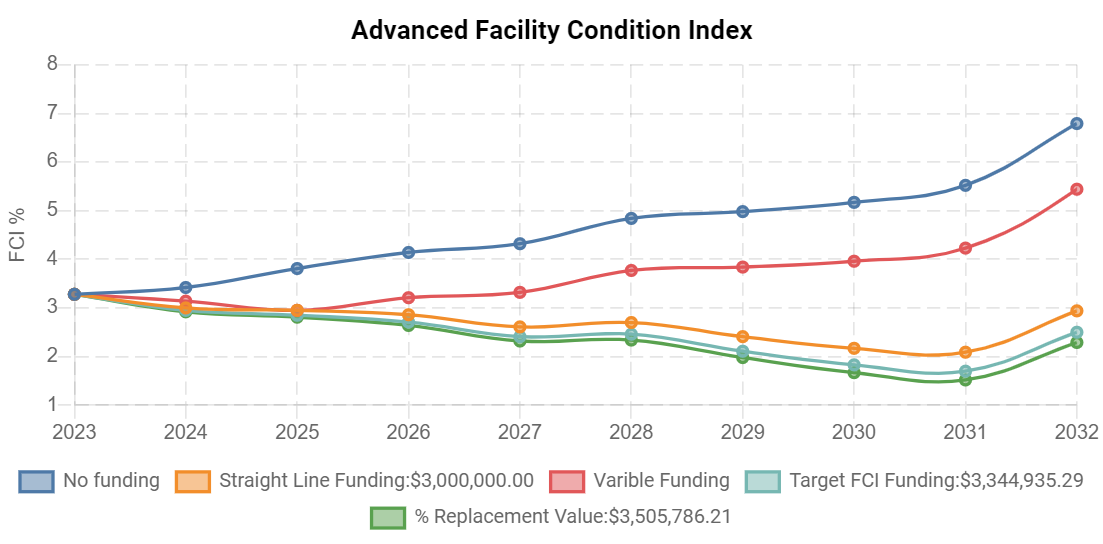

I am always very pleased when a client is successful in securing additional funding to...

Jul. 13, 2023

This one is going to be a short post, but I felt that it was...

Jul. 07, 2023

First off, let me start by saying I am not a heavy consumer of social...

Jun. 29, 2023

"Patience My Young Padawan," the wise and famous Obi Wan Kenobi said to his apprentice,...

Jun. 21, 2023

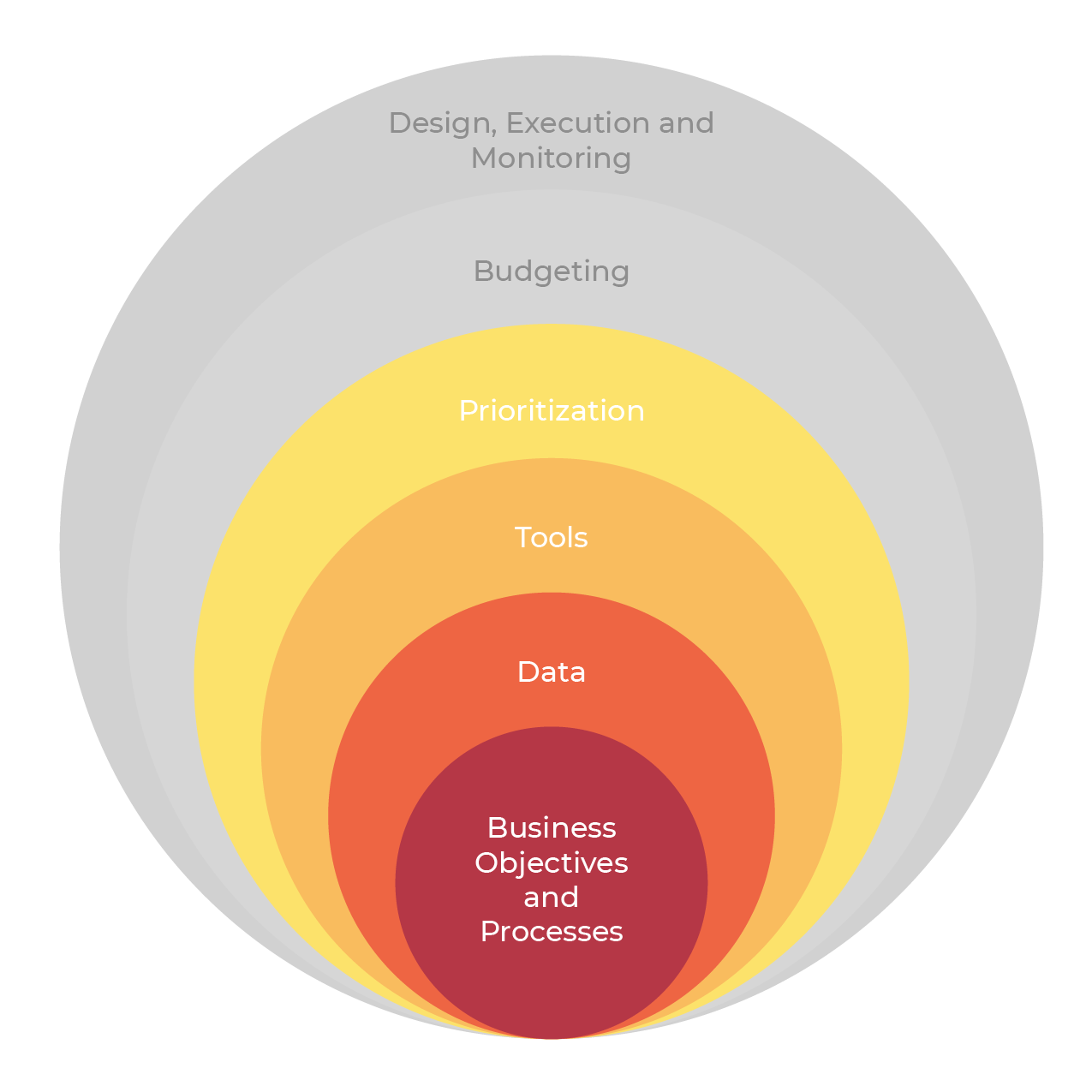

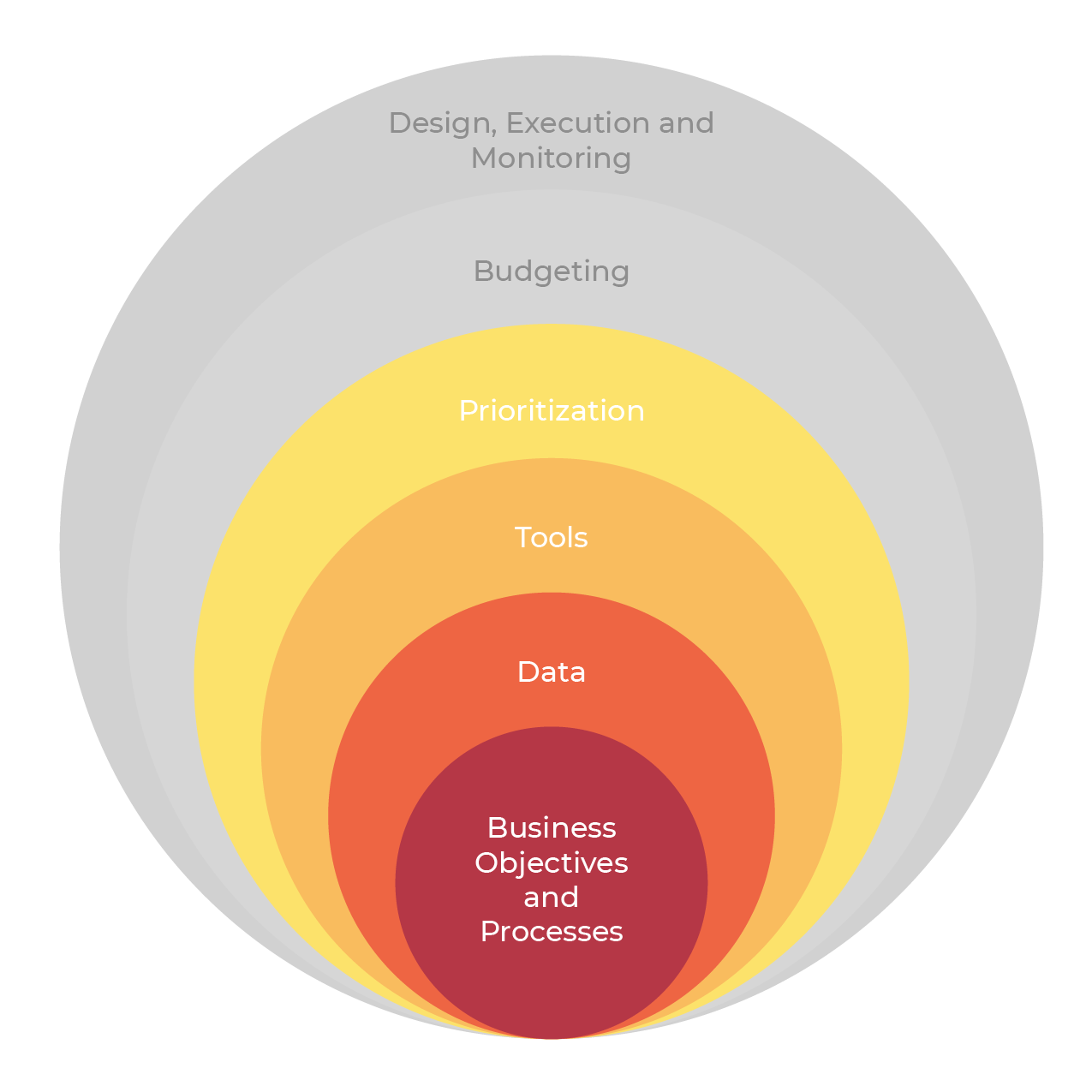

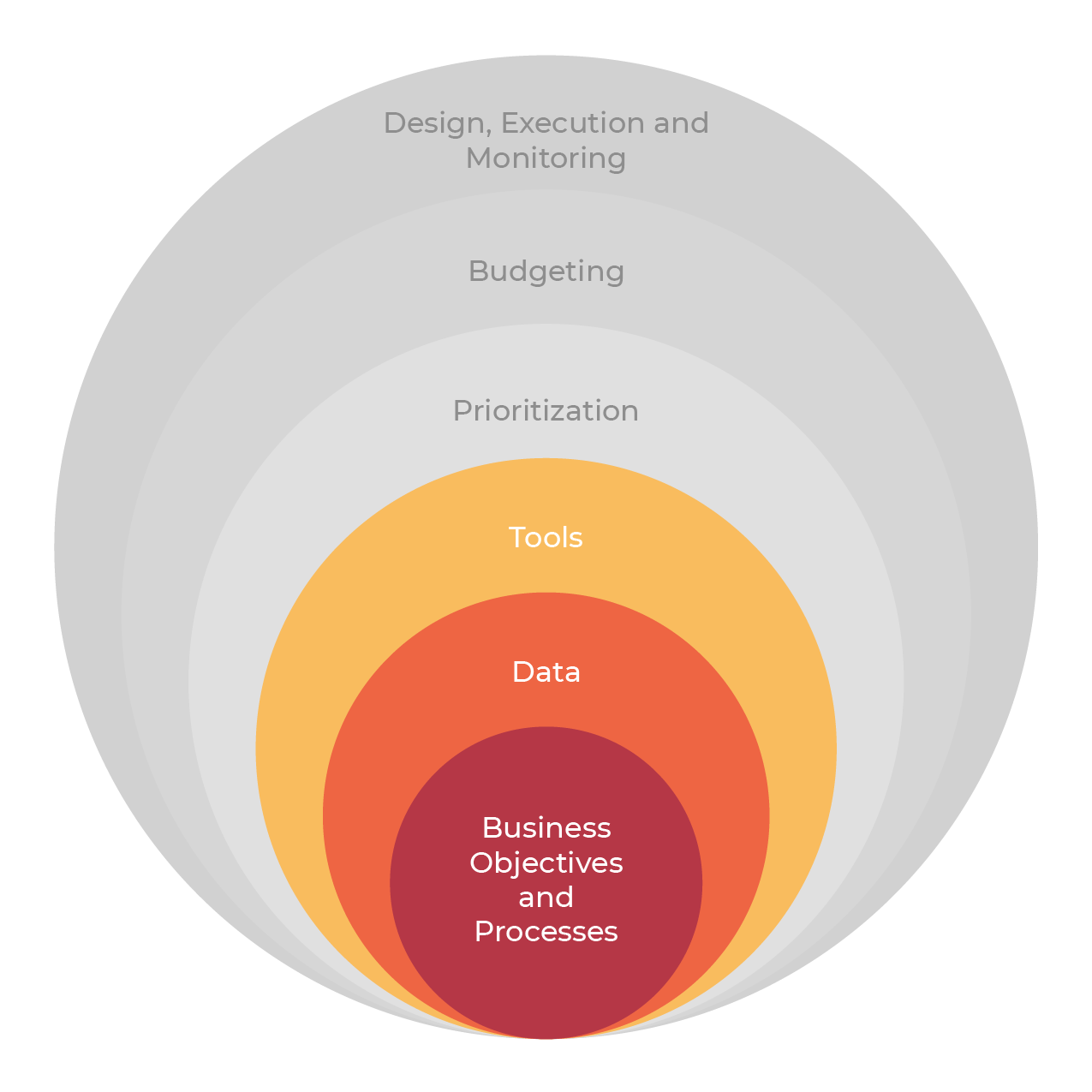

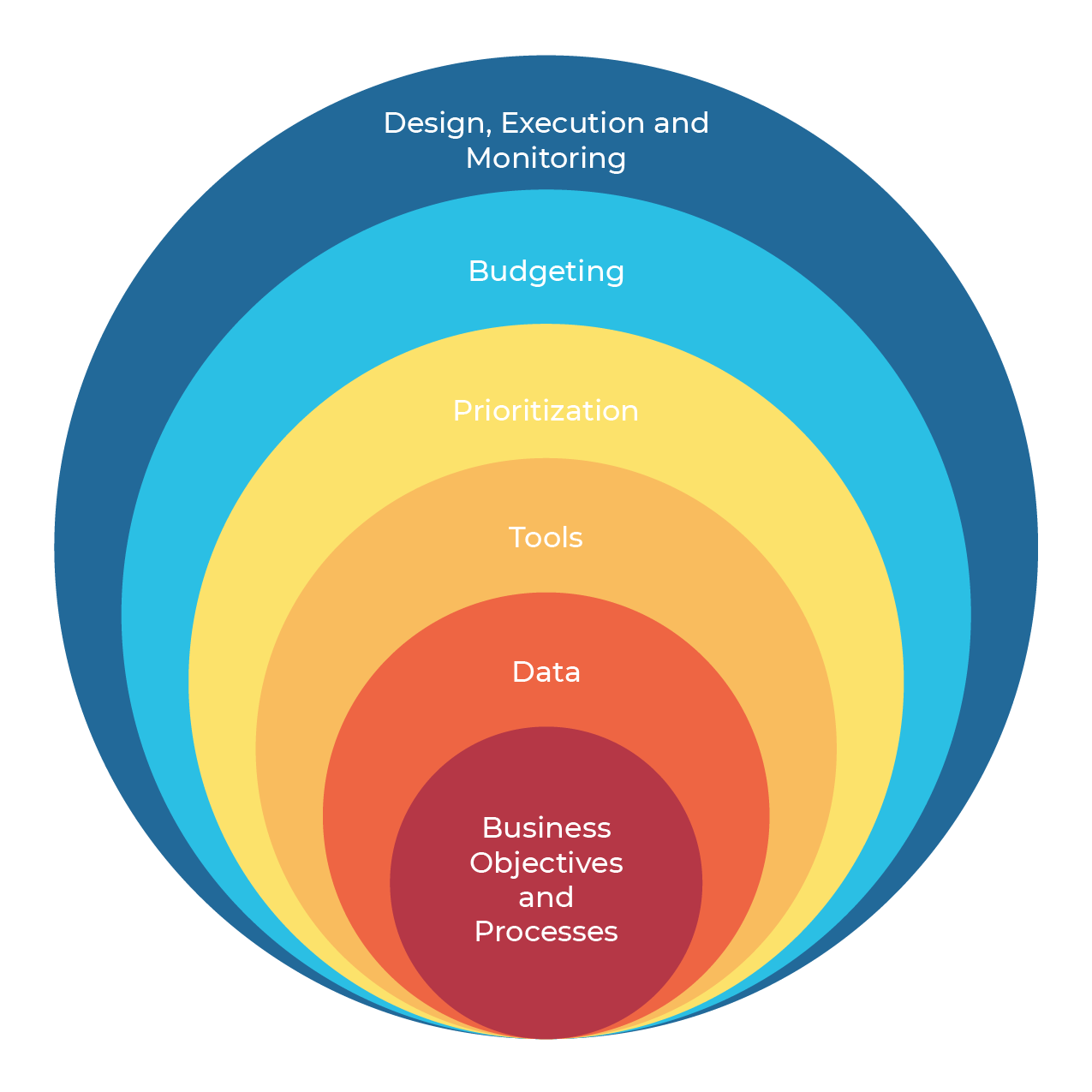

We made it!!! 15 Posts, nearly 4 months and we are at the final "Peeling...

Jun. 15, 2023

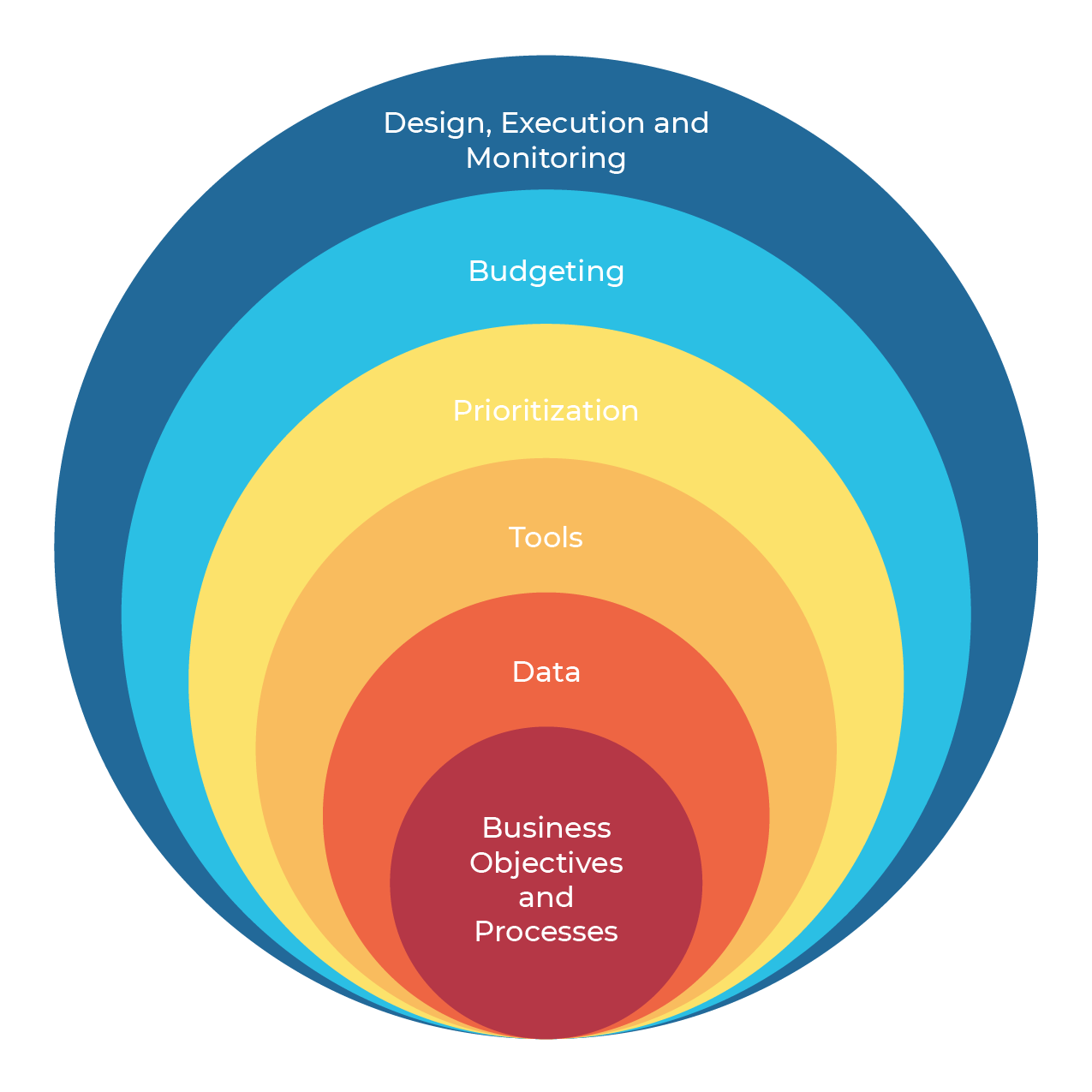

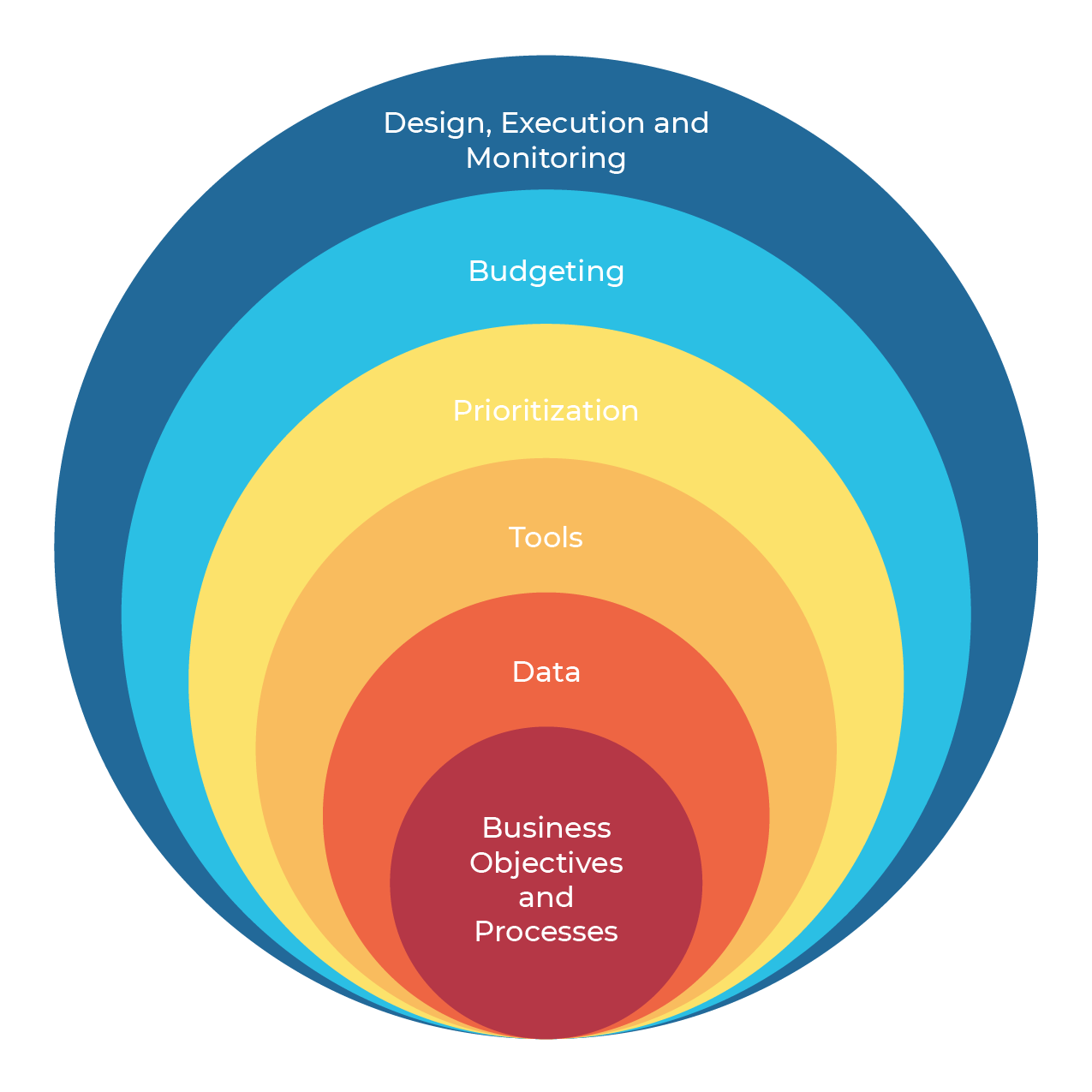

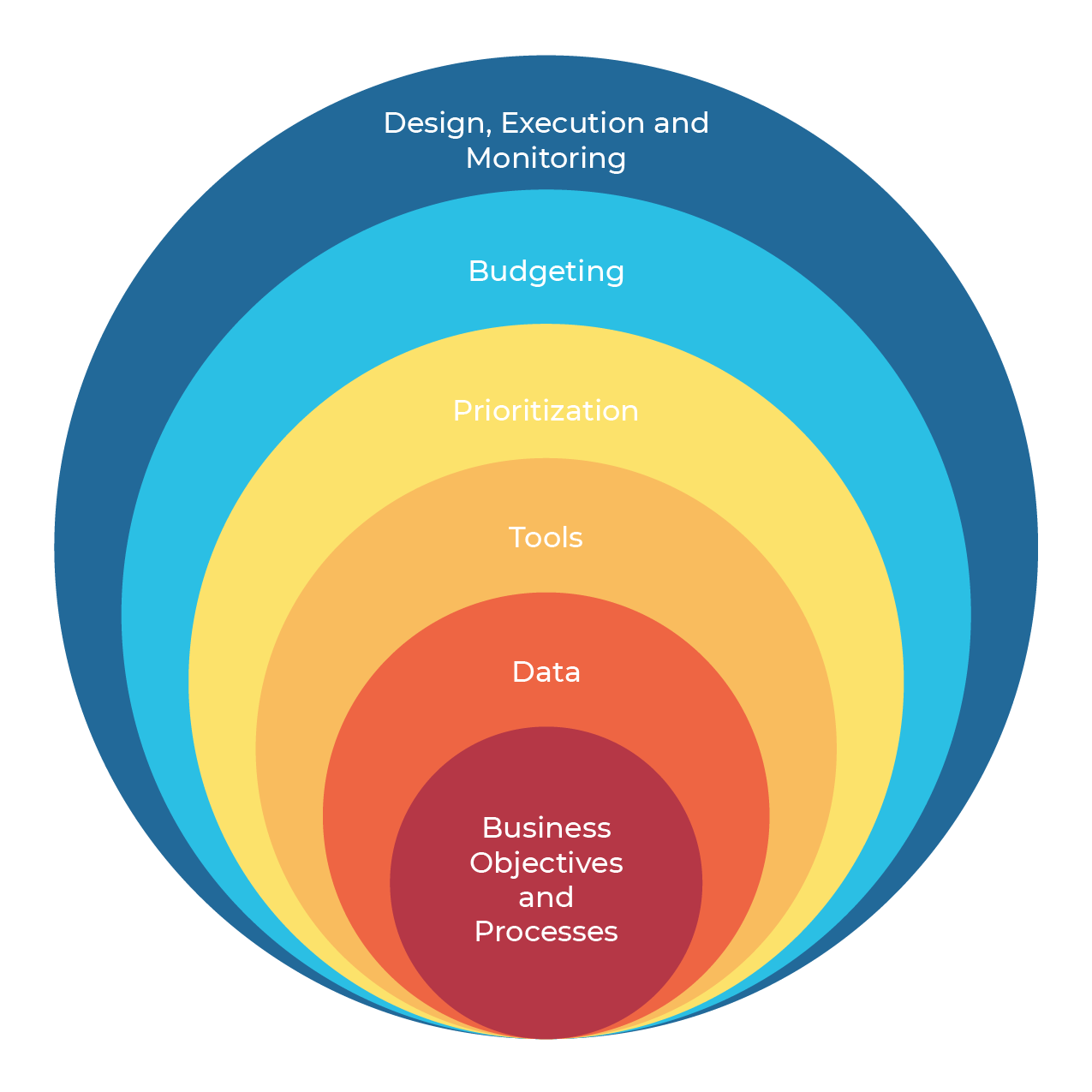

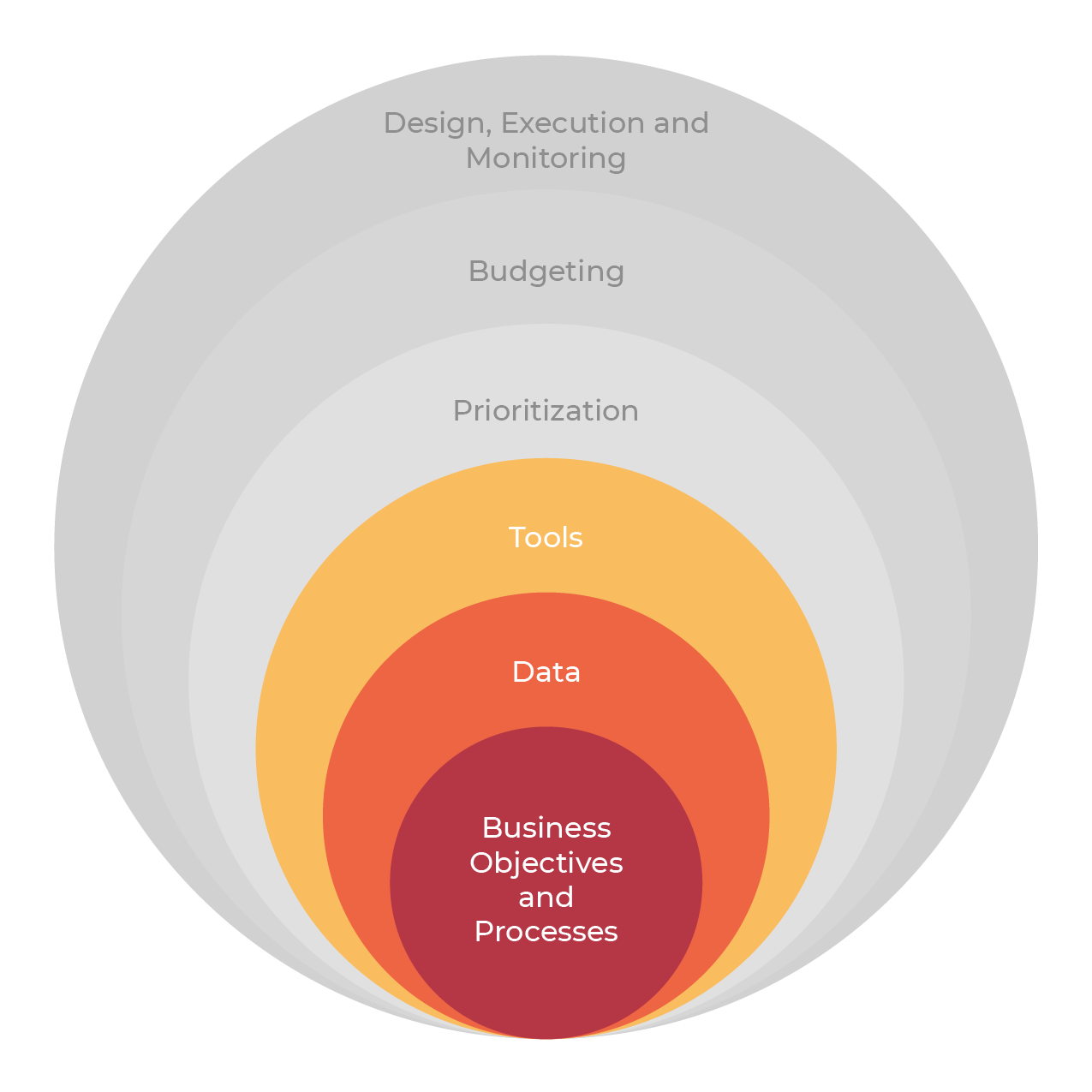

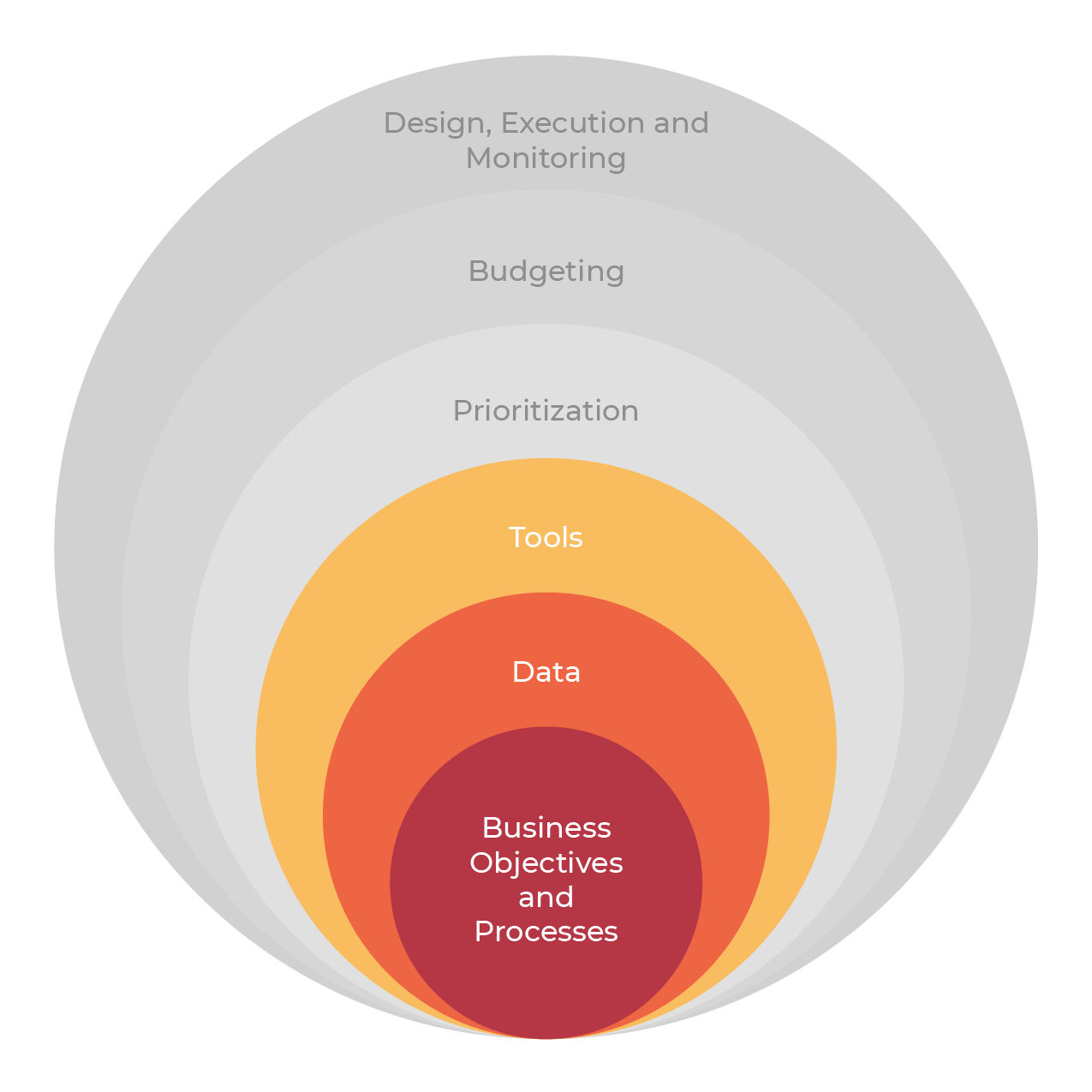

Here we are, the outer layer of the "Onion". All of the work that we...

Jun. 01, 2023

When I set out to write this series, I knew it was going to be...

May. 25, 2023

Nearly every public sector institution across North America (and around the world I presume) has...

May. 18, 2023

Going from a "list of needs" provided in an engineering report (i.e., a condition assessment,...

May. 11, 2023

A nearly universal challenge that organizations face is a lack of sufficient funding to address...

May. 05, 2023

In the last post, I provided support for the idea of using multiple different tools...

Apr. 27, 2023

In the last post, I talked about the first temptation of filling your tool best,...

Apr. 20, 2023

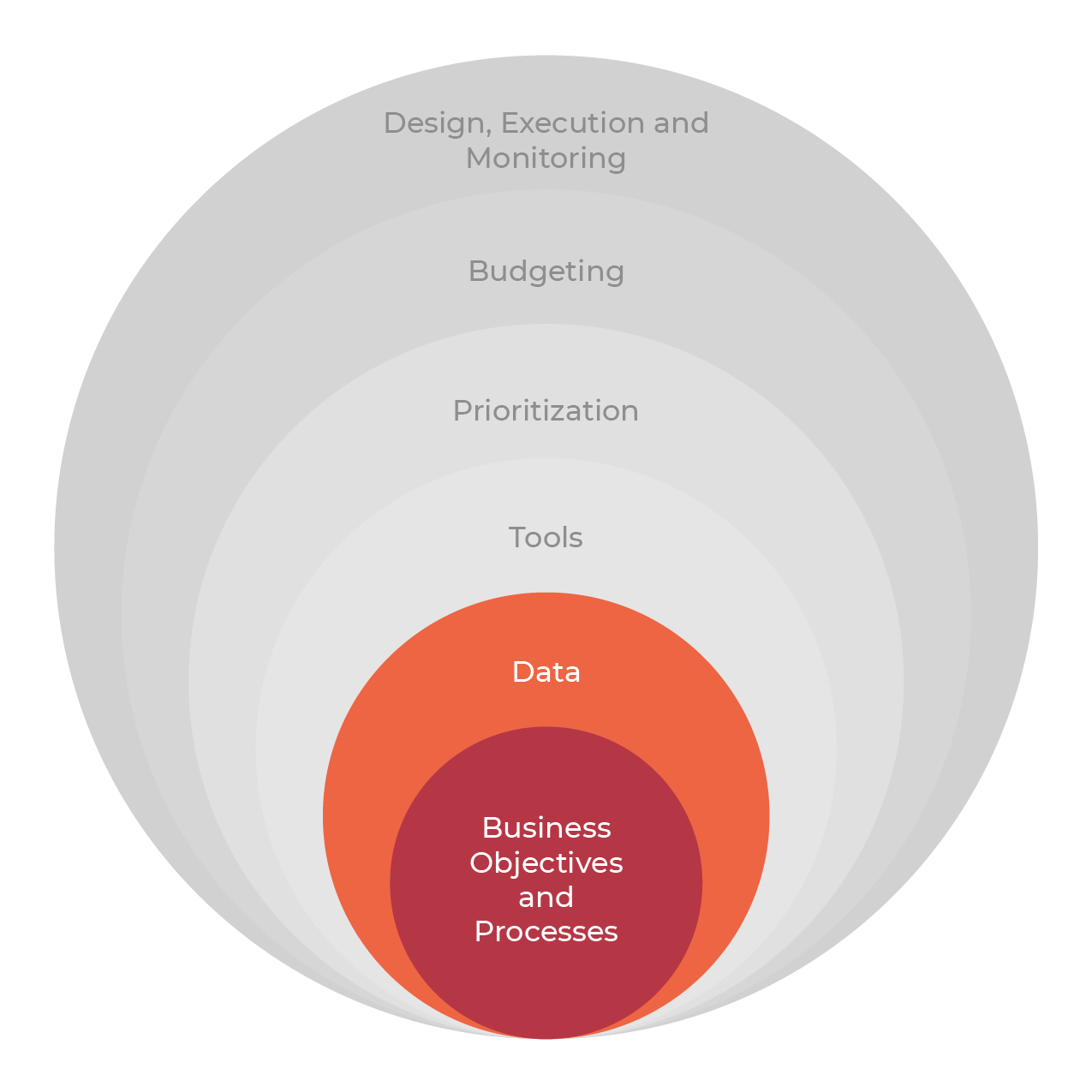

After six previous posts, we are now three layers into the Integrated Asset Management "Onion"....

Apr. 13, 2023

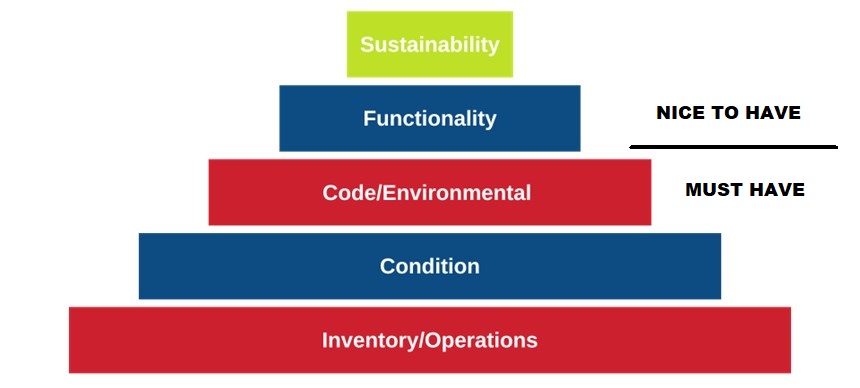

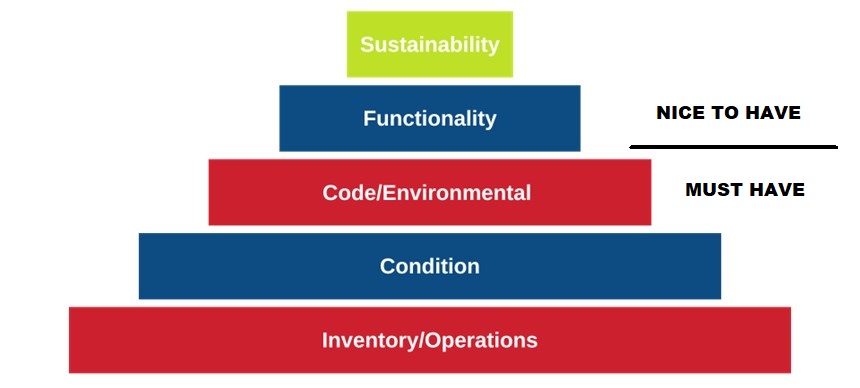

Our journey to the top of the Pyramid is almost complete. This post will explore...

Mar. 29, 2023

We are going to take a break from our regularly scheduled trip through the layers...

Mar. 20, 2023

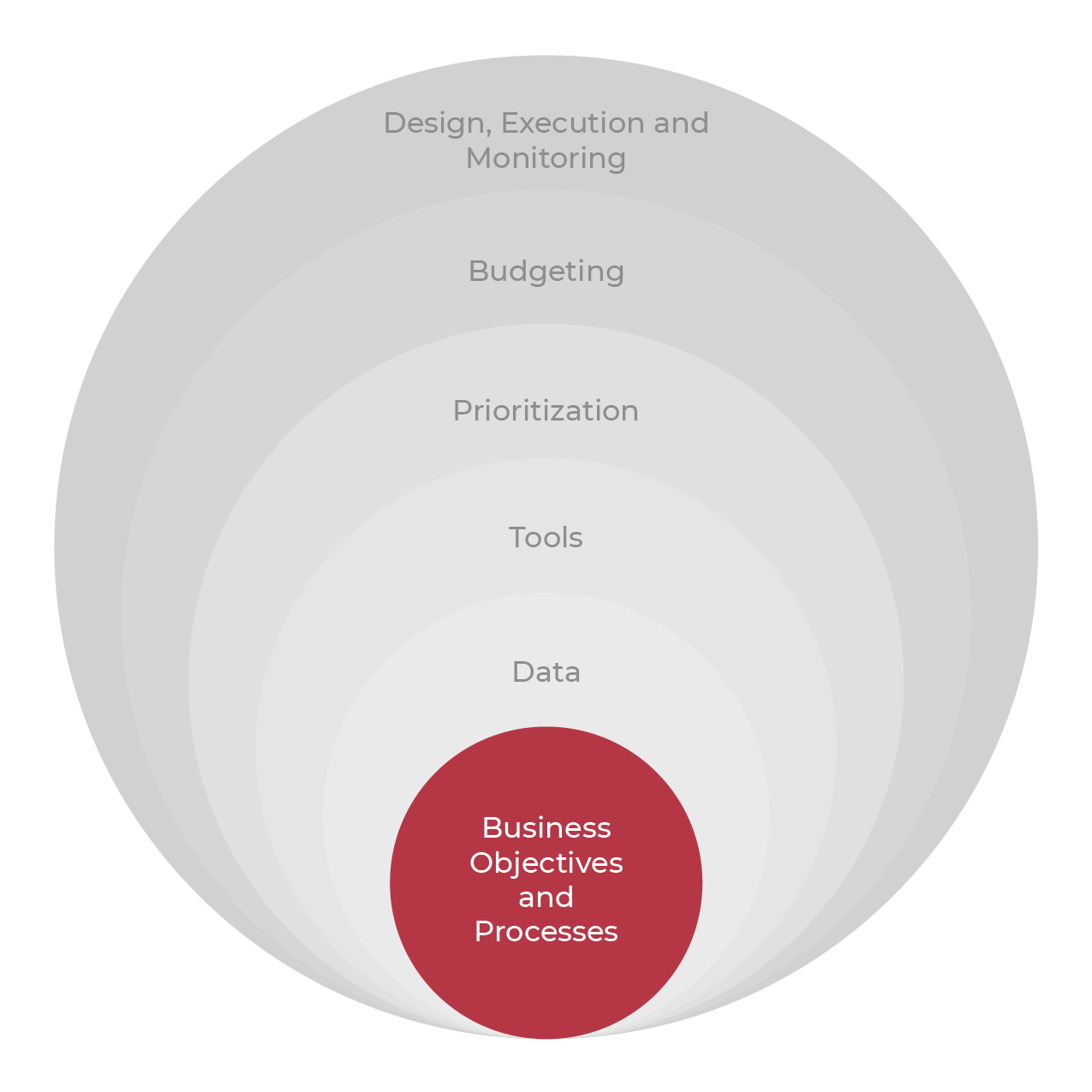

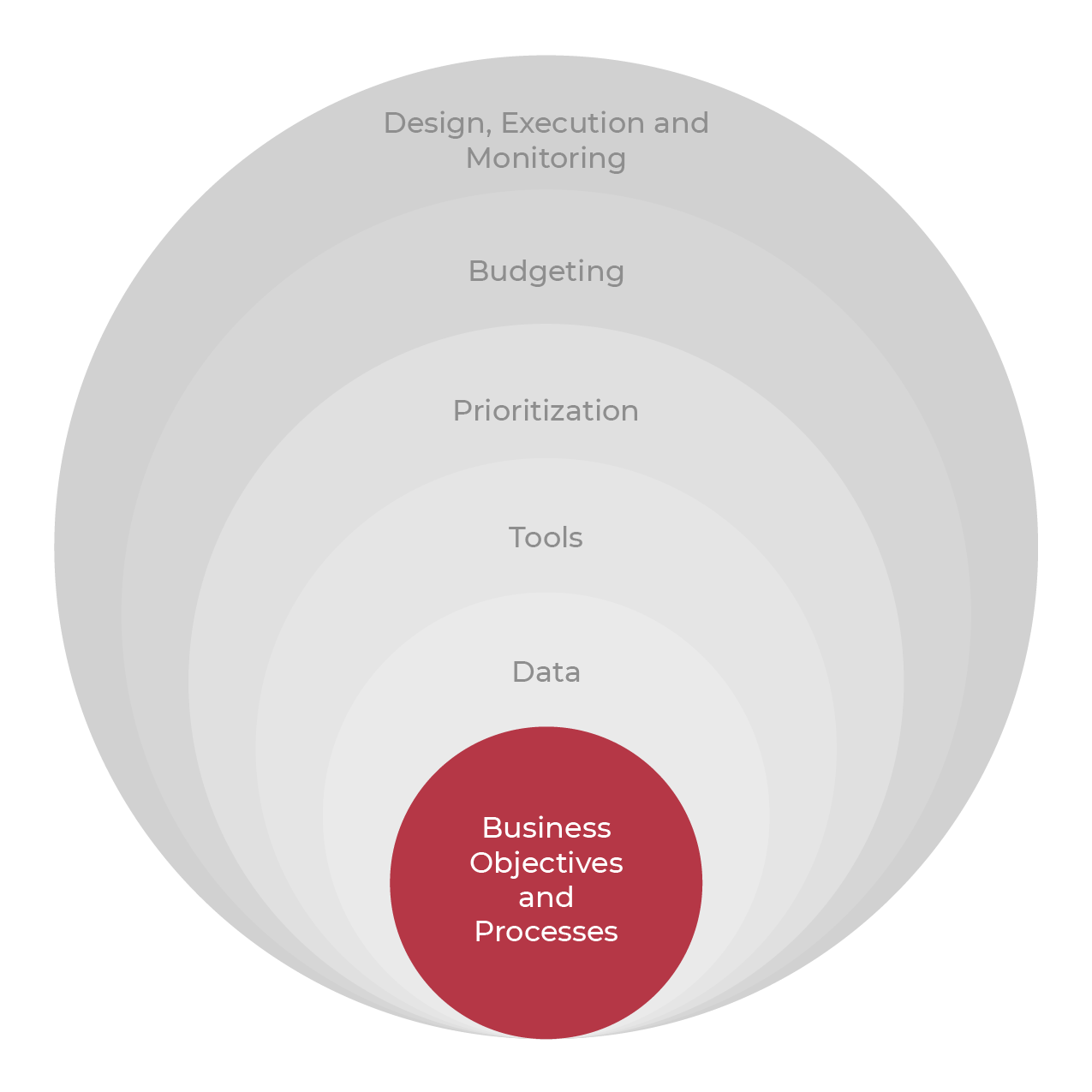

Today we are going to move beyond the core of the onion to the second...

Mar. 16, 2023

In the last post, I focused on the importance of aligning your Asset Management (AM)...

Mar. 09, 2023

Getting started can sometimes be the hardest part. The whole world is a blank sheet...

Mar. 02, 2023

What is in a name? It is an age-old question. I thought I would explore...

Feb. 23, 2023

I was recently asked, what is the best advice that you would give a professional...

Feb. 17, 2023

In my last two post, I reviewed the different considerations that one needs to factor...

Feb. 09, 2023

In Part 1 of this post, I introduced the idea of an evaluation period for...

Feb. 02, 2023

As on organization begins their asset management journey, one of the first questions that their...

Jan. 27, 2023

I am probably going to get a lot of heat for this post, but I...

Jan. 19, 2023

It always amazes me that some organizations that have millions (or billions) of dollars of...

Jan. 12, 2023

Building prioritized, multiyear capital plans is an exercise in juggling all the priorities that are...

Jan. 05, 2023

When we are collaborating with clients to support the development of prioritized, multiyear capital plans,...

Dec. 22, 2022

I have focused all my recent posts on technical topics related to facility and infrastructure...

Dec. 15, 2022

I just wrapped up a two-month series of posts on the evolution of the Facility...

Dec. 08, 2022

Last week I wrote about the influence that software has had on the evolution of...

Dec. 01, 2022

Over the past 6 posts, I have focused on the evolution and potential future for...

Nov. 24, 2022

As am I typing these words I am listening to the Hamilton soundtrack and this...

Nov. 18, 2022

No matter what type of organization you are a part of, you are going to...

Nov. 10, 2022

As we get into the mid-to-late 2010s, many clients were making informed decisions based on...

Nov. 03, 2022

Over the years, most FCAs were completed by design, project management and/or construction professionals "on...

Oct. 26, 2022

For over a decade, until around 2010, the FCA industry continued to be focused on...

Oct. 20, 2022

As we are in the middle of Fall conference season, I have been having many...

Oct. 13, 2022

I am by no means an exercise junkie. After struggling during the first few months...

Oct. 06, 2022

As I am writing this, I have just returned from the ERAPPA 2022 Conference at...

Sep. 27, 2022

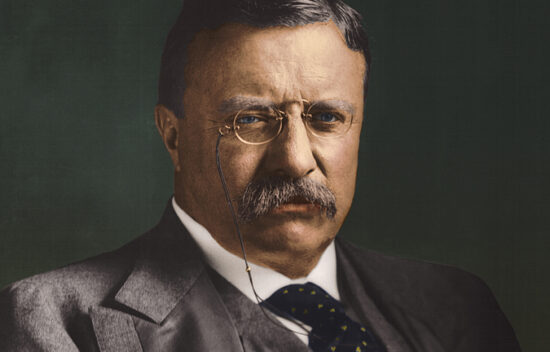

In my opinion, one of the greatest presidential speeches (and motivational speeches as well) in...

Sep. 22, 2022

Over the past number of years, you have heard a lot of "experts" say "Follow...

Sep. 15, 2022

In my previous post, I focused on some of the significant challenges that face organizations...

Sep. 07, 2022

I spend a lot of time speaking with Higher Education clients and potential clients in...

Aug. 30, 2022

Whenever it is possible, within the client's schedule, we will always recommend that a Pilot...

Aug. 18, 2022

As we (hopefully) are moving into the endemic phase or perhaps it’s the "live with...

Aug. 11, 2022

Having been involved in hiring professional site assessment staff for over 20 years, I have...

Aug. 04, 2022

Whenever an organization puts out a public RFP document, in some ways they are "rolling...

Jul. 18, 2022

One of the most common questions that I get with our Collaborative Procurement contracts with...

Jul. 05, 2022

I have just returned from the annual Sourcewell H2O conference in beautiful Brainerd, Minnesota (Where...

Jun. 08, 2022

When I speak with clients or prospects about increasing their team's focus on Facility and...

May. 27, 2022

As an individual I cannot imagine anyone that would not cringe at the thought of...

May. 05, 2022

I am an avid lifelong learner. It has always been hard to succeed if you...

Apr. 28, 2022

In 2019, my grandmother spent considerable time in the hospital as a result of complications...

Apr. 18, 2022

One of our core values is Passionate. I often get asked why I am personally...

Apr. 06, 2022

Welcome to our new Blog. I am Bill Roth, President & CEO of Roth IAMS. ...

Aug. 17, 2021

As we begin to come out of COVID-19 we are starting to see evidence that...

Apr. 13, 2021

Canadian-based Facility and Infrastructure Asset Management company, Roth IAMS is pleased to announce that they...

May. 12, 2020

On May 4, the Roth IAMS family sadly lost one of its most important members. Tim...